Smart Corporate Card Reconciliation

for Smarter Businesses

Keep your business expenses all in one place with Capture Expense’s automated credit card reconciliation software—bringing all your spend under one roof, in real-time.

Intelligent brands taking total control of company spend

Simplify your corporate card reconciliation

Creating and submitting expenses has never been so easy. There are just three simple steps to your company credit card reconciliation:

1

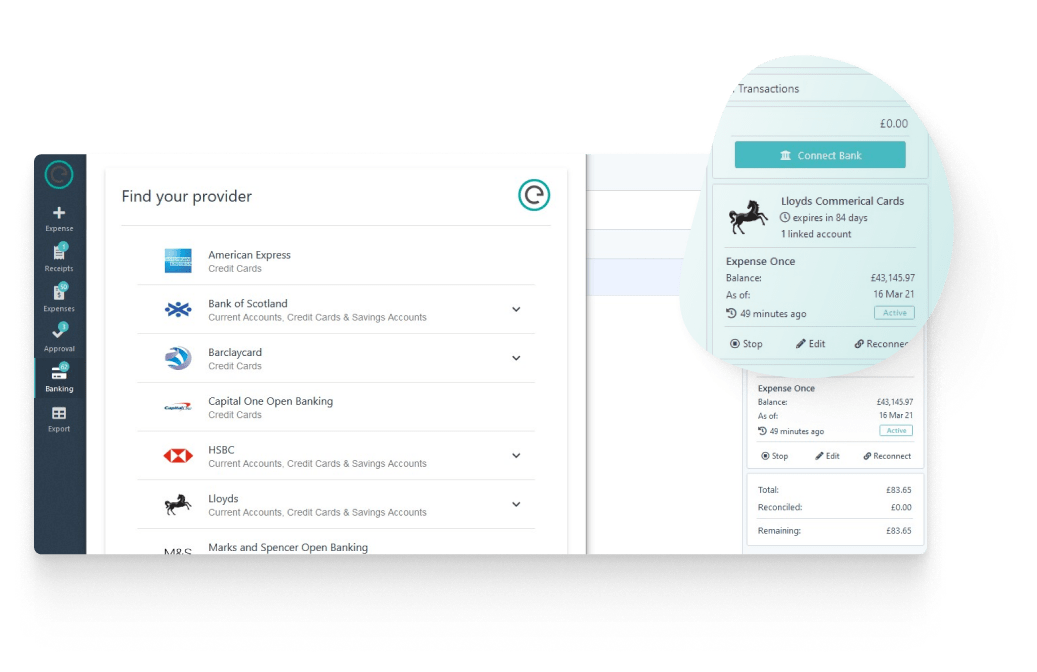

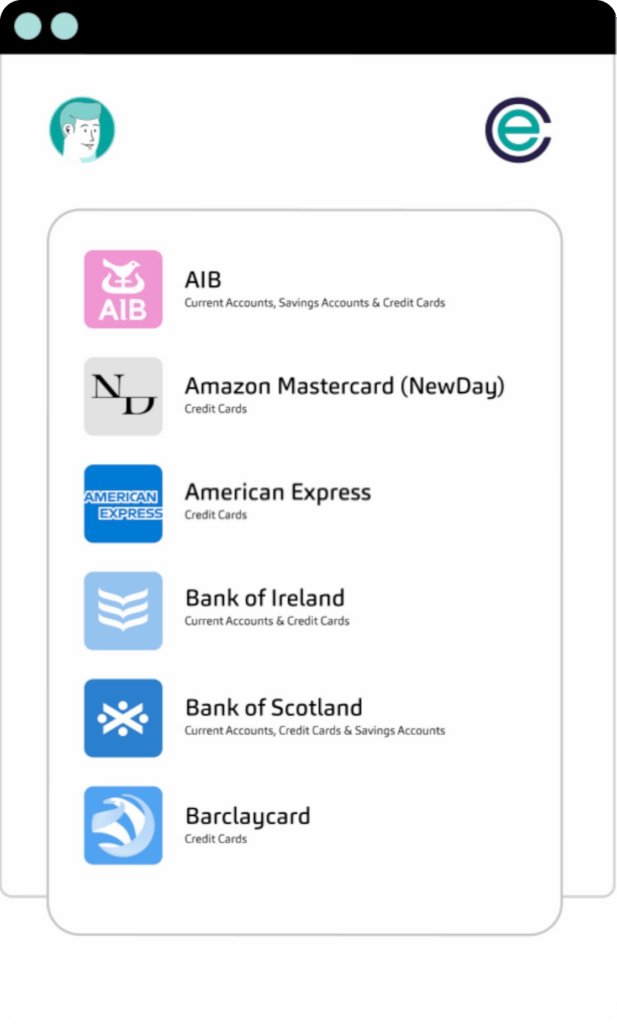

Link your corporate cards

Connect your teams credit card with your account just once and see all your spend in one place.

2

Attach invoices and receipts

Simply upload or forward documents by email for automatic reconciliation by card holder.

3

Approve and report

Transactions are reported in accounts on the same day. No more month end delays.

Capture Expense Brochure

Unlock the power of real-time spending insights across your entire organisation. Dive into our brochure to discover how you can stay on top of reimbursements, bills, and credit card transactions as they happen, ensuring smarter financial decisions.

Straight-forward company credit card reconciliation

Using cutting-edge open banking technology, we seamlessly integrate with a network of banks and corporate cards, including ClearSpend, Barclaycard, and MiVision.

By connecting your corporate cards with Capture Expense, you’ll increase the speed and accuracy of your reconciliation processes—freeing you up of days and hours’ worth of work.

Integrate with Clearspend and Barclaycard

Bringing all your organisational spend under one roof with automated card reconciliation

With Capture Expense’s credit card reconciliation software, you’ll gain:

Real-time transactions feed

Connect your corporate card account for real-time transactions feed and automatic reconciliation with invoice and receipts.

Total expenditure overview

Your custom automatic feed of credit card transactions means you’ll never forget a purchase again.

Simplified transactions

Utilise the power of open banking to seamlessly and effortlessly integrate your company cards.

The power of open banking and expense management, together

By making the most of integrating open banking and expense management, you’ll benefit from:

- Automated data capture

- Real-time, automated credit card reconciliation

- Total expense accuracy and efficiency

- Improved compliance

- Better insights and reporting

I am really impressed with the Capture Expense product and service. We had additional requirements which they were happy to scope and develop the platform to meet our needs. Their customer service is great and they always resolve any problems or queries that arise. Capture Expense truly puts their customers first and I couldn’t be happier with their service!

– Group IT Manager

FAQ’s

What is a credit card reconciliation?

Credit card reconciliation involves comparing transactions listed on a credit card statement with the company’s ledger. It’s conducted before monthly, quarterly, and annual financial closes to ensure all transactions align correctly. This process helps detect discrepancies, errors, or missing entries, ensuring the integrity of financial records and supporting transparency in financial management.

What documents do you need for company credit card reconciliation?

For credit card reconciliations, you typically need the following documents:

- Credit card statements: Obtain the monthly credit card statements from the credit card provider for the period being reconciled.

- Receipts and invoices: Gather receipts, invoices, or other supporting documentation for each transaction listed on the credit card statement. These documents provide details such as the date, amount, vendor/supplier name, and description of the goods or services purchased.

- Company ledger or accounting records: Access your company’s ledger or accounting software where transactions are recorded. This serves as the reference point for comparing and reconciling transactions from the credit card statement.

- Expense reports: If your company uses expense reports for tracking employee expenses, you may need to reference these documents to ensure all reimbursable expenses are accurately recorded and reconciled.

Why should I use corporate card reconciliation in Capture Expense?

Capture Expense is the ultimate easy-to-use expenses platform, and our credit card reconciliation software is no different. We make it simple for you and your leaders to identify trends, monitor spend, and keep on top of budget a cash flow. Capture Expense is highly configurable, yet incredibly easy for everyone to understand.

As part of the Payroll Software and Services Group (PSSG), we’re always investing more into the development of our expense management solutions. But it also means we’re able to offer our customers a full suite of deeply integrated payroll and HR solutions that are leading the way in both UK and global markets.

How do you reconcile a company credit card?

Here’s how the credit card reconciliation process typically works:

- Gathering statements: Obtain the credit card statements for the period you’re reconciling, usually monthly.

- Reviewing transactions: Compare the transactions listed on the credit card statement with the transactions recorded in your accounting software or financial records. This includes ensuring that the amounts, dates, and descriptions match.

- Identifying discrepancies: If there are any discrepancies between the credit card statement and your records, investigate and reconcile them. Common reasons for discrepancies include missing or duplicate transactions, incorrect amounts, or transactions that haven’t been recorded.

- Adjustments: Make any necessary adjustments to your accounting records to correct errors or omissions found during the reconciliation process.

- Reconciliation: Once all transactions have been reviewed and any discrepancies resolved, reconcile the credit card statement with your accounting records. This involves confirming that the ending balance on the credit card statement matches the balance in your records after adjustments.

- Documentation: Keep records of the reconciliation process, including any notes or explanations for adjustments made.

What are the benefits of automating credit card reconciliation?

Here’s just a few benefits to using automated credit card reconciliation:

- Time savings: by eliminating manual data entry, you’ll save you and your finance teams days and hours of work.

- Accuracy: by reducing the risk of human errors associated with manual reconciliation.

- Real-time visibility: through real-time transactions feeds and reconciliation status.

- Scalability: by using a solution that can easy scale to accommodate growing transaction volumes.

Extra features alongside your corporate card reconciliation

Reimbursements

Easily approve and manage reimbursements in Capture Expense, syncing data with finance and payroll for total ease.

Receipt Scanning

Enable your teams to snap and send receipts on-the-go, automatically creating and raising expenses.

Vehicle Mileage

Never miscalculate mileage again with Capture Expense’s smart automation, for accurate tax reclaims every time.